Divorce or separation can have a significant impact on your credit rating, influencing your financial stability and future borrowing capacity.

Understanding how these life changes affect your credit and knowing how to manage your credit rating effectively is crucial for rebuilding and maintaining your financial health.

Here’s what you need to know about credit ratings following a divorce or separation and how you can safeguard your financial future.

1. The Impact of Divorce on Your Credit Rating

Divorce itself does not directly affect your credit rating. However, the financial changes that come with a divorce can indirectly influence it. If you and your ex-spouse had joint accounts or shared debts, these can impact your credit score. For instance:

Joint Accounts: Any missed payments or high credit card balances on joint accounts can affect both parties’ credit ratings. It’s essential to close or separate joint accounts as part of the divorce settlement to avoid future credit issues.

Debt Division: The court may order that certain debts be assigned to one party or the other. If these debts are not managed properly or if payments are missed, it can negatively affect your credit score.

2. Reviewing and Updating Your Credit Reports

After a divorce or separation, it’s important to review your credit reports from the major credit bureaus—Equifax, Experian, and TransUnion. Check for any inaccuracies or outdated information related to joint accounts or debts.

Dispute Errors: If you find errors or accounts that should not be in your name, dispute them with the credit bureaus to have them corrected.

Monitor Regularly: Regularly monitoring your credit reports can help you stay aware of your credit status and catch any potential issues early.

3. Separating Finances

One of the first steps to managing your credit post-divorce is to separate your finances from your ex-spouse’s. This involves:

Closing Joint Accounts: Work with your ex-spouse to close any joint credit accounts. If this isn’t possible, ensure that all debts are paid off or transferred to one party’s name.

Opening New Accounts: Establish your own credit accounts, such as credit cards or loans, in your name only. This helps build and maintain your credit profile independently.

4. Managing Your Debt

Effective debt management is crucial for maintaining a healthy credit rating:

Pay Bills on Time: Ensure that you make all your payments—credit cards, loans, and other bills—on time. Late payments can significantly impact your credit score.

Reduce Debt: Work on reducing any existing debt and avoid accumulating new debt. This can help improve your credit score over time.

5. Building Your Credit

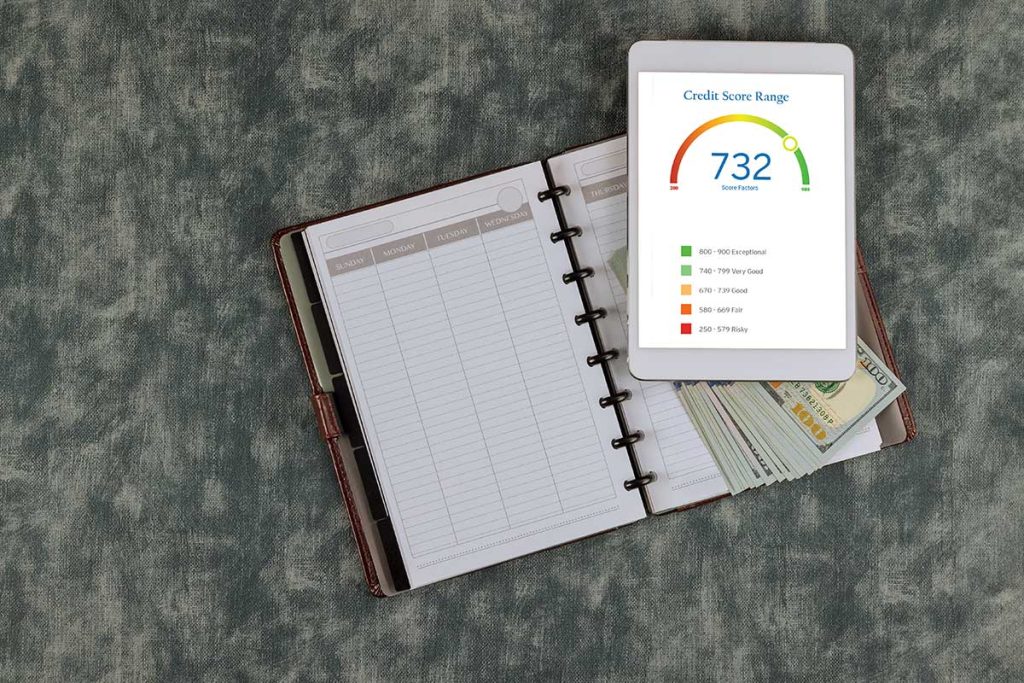

Rebuilding or improving your credit rating after a divorce involves positive financial behaviours:

Use Credit Wisely: Use credit cards responsibly by keeping balances low and paying off the full amount each month to avoid interest charges.

Monitor Your Credit Utilisation: Aim to keep your credit utilisation ratio (the percentage of available credit you use) below 30%. High credit utilisation can negatively affect your credit score.

Consider Secured Credit Cards: If you need to rebuild your credit, a secured credit card, where you deposit a sum of money as collateral, can help you establish a positive credit history.

6. Seeking Professional Advice

If you’re struggling to manage your credit or understand the impact of divorce on your financial situation, consider seeking advice from a financial advisor or credit counsellor. These professionals can offer personalized guidance and strategies to help you rebuild and maintain a strong credit rating.

7. Legal Considerations

In some cases, legal advice might be necessary, particularly if there are disputes over debt responsibility or joint accounts. Consulting with a lawyer who specializes in family law can ensure that your financial interests are protected in the divorce settlement.